Quick Guide to Funding Options for Real Estate Developers

A Real Estate Developer needs funding at various stages and purposes during the development of the project. This article is a quick guide to facilitate fund raising by Developers.

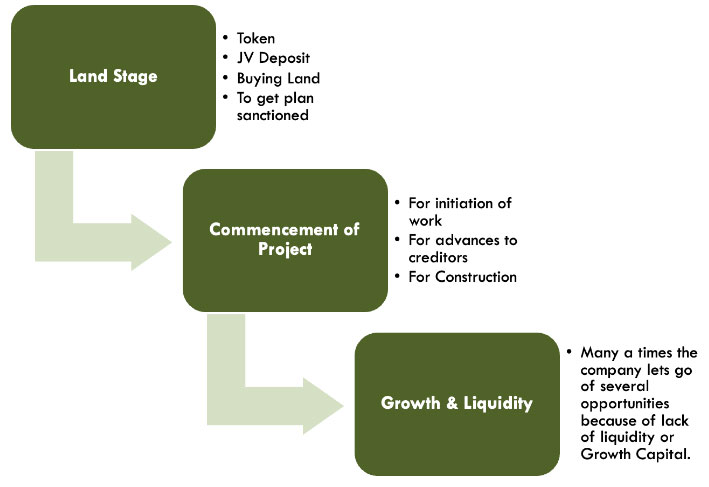

Why & When would a Developer need money?

It is important to note here that you should not just to get the money, but to get it at the right time! Any issue in raising money of a previous stage directly affects the later stage. E.g. Cash flows from sales cannot start till there is RERA registration and that is dependent on sanction of plans. So even though you may have buyers ready with cash, since you could not arrange funding for a previous stage, there was a cash flow issue. Also it is to be noted that, as per RBI guidelines, Banks cannot directly provide loan for buying Land.

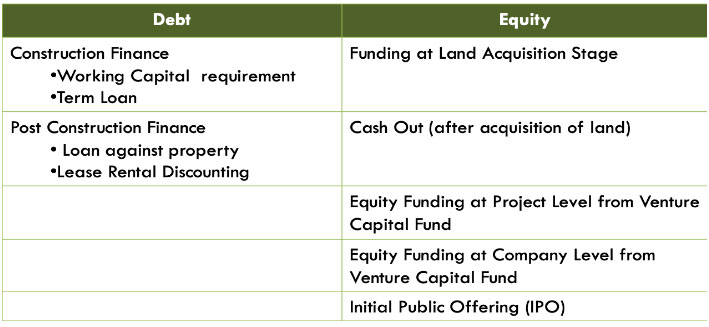

What are the funding options for the Developer?

Now, let us look at the positives and negatives between Debt & Equity options

Loans

Positives

- Can be secured by providing security and sufficient collateral

- Relatively lower cost than equity funding

- No need to share profits with the Lender

Negatives

- Limitation on the amount which can be raised

- In case of slowdown, repayment of principal and interest becomes a burden

- Bank does not share Project risk

Equity

Positives

- Investor shares the risk of the Project

- Enables Company to raise additional Debt Funding

- Market perception of companies having equity financing is generally better

Negatives

- Relatively high cost of capital over a long period of time.

- Private equity needs exit avenues over a period of time.

- Additional compliance requirements and public scrutiny of companies accessing public markets.

- Would want to get involved in some key management decisions.

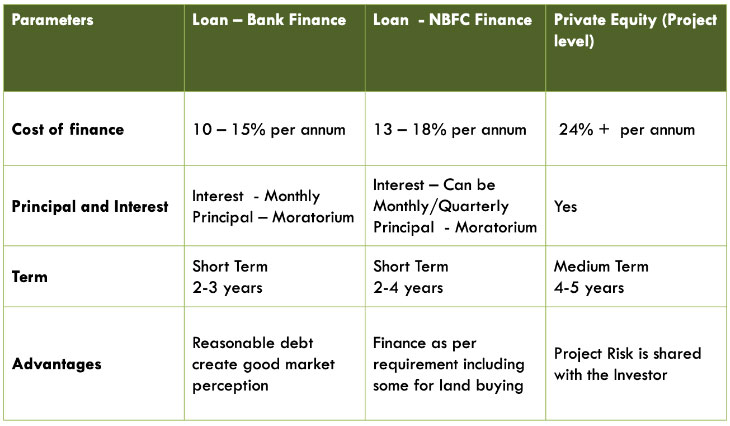

How should you evaluate your funding options?

Before taking funding, you should compare the impact of various avenues of funding in with distinct parameters.

CA Vinit V Deo

Posiview Consulting Partners Pvt Ltd